Don't Just "Buy a House." Acquire an Asset.

In Houston’s competitive market, you don’t just need someone to open doors—you need a strategist. Whether you’re a first-time buyer or an investor, we work to secure the best terms and position you for a successful acquisition.

Why Online Search Isn't Enough.

Apps are great for window shopping, but they don't tell the whole story. By the time you see a "Hot Home" online, it's often already under contract.

The RIMT Advantage:

-

The Hidden Inventory Advantage: We actively search “Coming Soon” properties and overlooked older listings to uncover your next real estate opportunity.

-

The "Lemon" Detector: We walk the property with you to spot red flags and flood concerns, before you fall in love with the kitchen.

-

The Rate Hacking: We work with lenders who know how to buy down your rate, saving you hundreds per month.

The Path to "Clear to Close"

The Strategy Session

We sit down (or Virtual) to define your "Must Haves" vs. "Nice to Haves." We align your budget with the reality of the Real Estate market so you never waste a Sunday afternoon.

The Hunt

We tour homes with a critical eye. We don’t just look at the paint— we walk the property as if we were buying it ourselves. You’ll also receive neighborhood insights so you can complete your own due diligence with confidence.

The Offer

This is where we shine. We craft offers that sellers respect but that protect your wallet. We negotiate repairs, closing costs, and terms aggressively.

The Keys

From the first showing to the closing table, we’re with you every step of the way. We coordinate with everyone involved to keep the process smooth and stress-free — so you can focus on the fun part: planning your housewarming party.

Where We Serve

Every neighborhood has a heartbeat. We help you find the one that matches yours.

Houston

The energy, the culture, and the diversity. From high-rises to historic bungalows.

Katy

Top-tier schools, master-planned communities, and family-focused living.

Cypress

The perfect blend of suburban luxury, golf courses, and retail convenience.

Tomball

Small-town charm with big-city access. A community that feels like home.

Spring

Rapid growth, incredible parks, and smart investment opportunities.

Get The "Unfair Advantage"

Don't enter the market blind. Download our Exclusive Buyer's Guide.

The truth about Closing Costs in Texas

How to win a bidding war without overpaying

The "Red Flags" checklist for inspections

Ready to Stop Renting?

The best time to plant a tree was 20 years ago. The second best time is today. Let's find your place in the world.

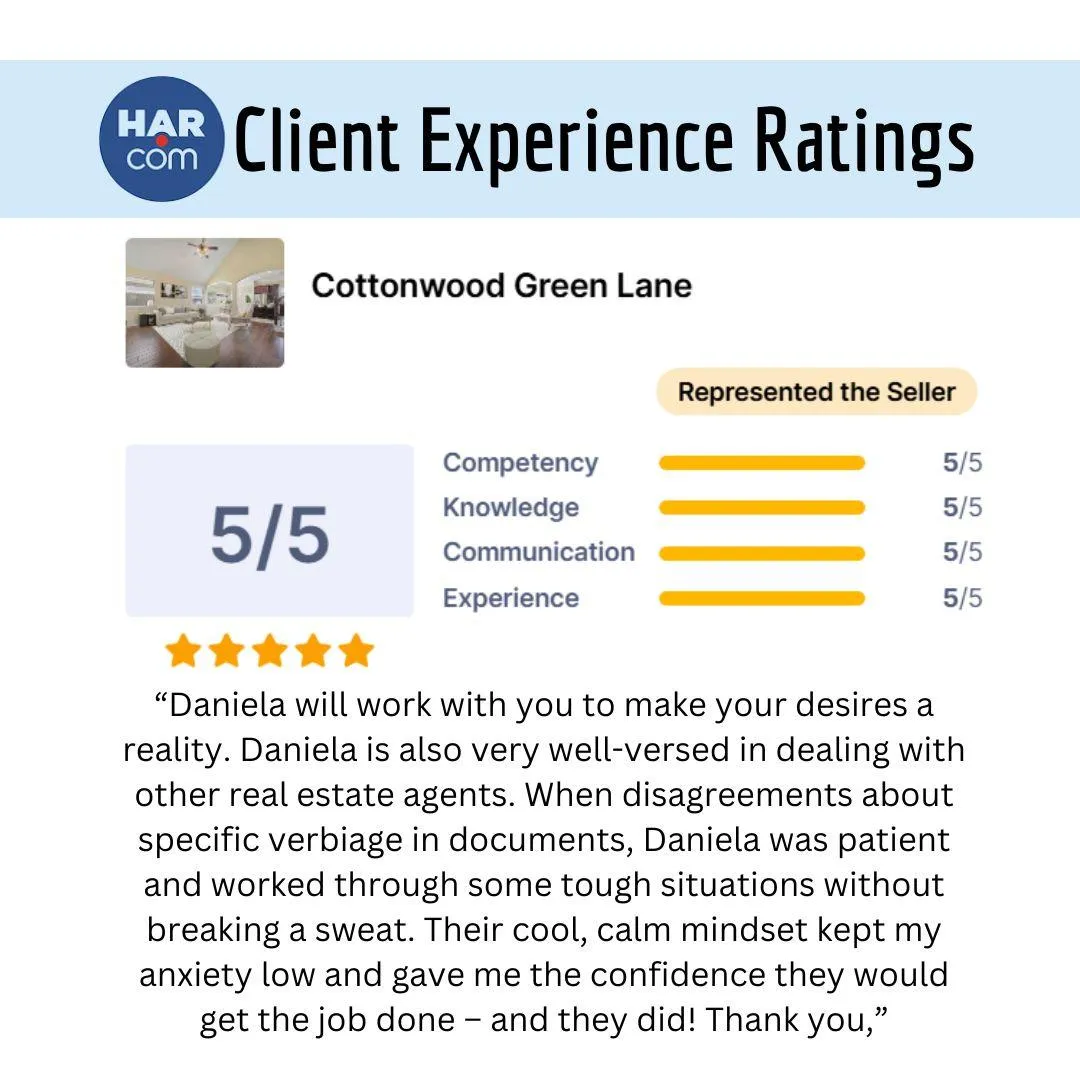

Previous Home Buyers

They Found Their Dream Home. You're Next

Calculator & FAQs for Homebuyers

🏠 Buyer's Financial Suite

🏙️ Full Monthly Payment (PITI + HOA)

📈 Debt-to-Income (DTI) Analyzer

🗓️ Amortization & Payoff Savings

💸 Buyer Net Sheet (Cash to Close)

1. How do I know if I’m ready to buy a home?

Buying a home is a big step! You’re financially ready if you have stable income, a good credit score, and savings for a down payment and closing costs. You’re emotionally ready if you plan to stay in the home for at least a few years. A realtor can help you evaluate your situation and guide you through the process.

2. How much money do I need to buy a house?

Your budget depends on the home price, down payment, closing costs, and monthly mortgage. Some loan programs allow as little as 3% down, and Texas offers assistance programs for first-time buyers. A realtor can connect you with trusted lenders who explain your best financing options.

3. What credit score do I need to buy a home?

Most lenders prefer a credit score of 620 or higher, but FHA loans allow scores as low as 580 with a 3.5% down payment. A realtor can recommend lenders who help improve your credit and find the right loan for you.

4. Do I need to get pre-approved before looking at homes?

Yes! Pre-approval shows sellers that you’re a serious buyer and tells you how much home you can afford. A realtor can introduce you to top lenders and ensure you have a strong pre-approval letter.

5. How do I choose the right neighborhood?

Consider factors like schools, commute times, safety, property taxes, and amenities. A local realtor has expert knowledge of Houston’s different areas and can help you find a neighborhood that fits your lifestyle and budget.

6. What are closing costs, and how much are they?

Closing costs include lender fees, title insurance, home inspection, appraisal, and other charges, usually 2-5% of the home's price. Your realtor negotiates with the seller to see if they’ll help cover some of these costs.

7. Do I really need a realtor when buying a home?

Absolutely! A realtor protects your interests, negotiates the best deal, and handles all the paperwork. In most cases, the seller pays the buyer’s agent commission, meaning you get expert guidance at no extra cost!

8. How long does it take to buy a house?

The homebuying process typically takes 30-60 days once your offer is accepted. However, if you’re still house-hunting, it could take longer. A realtor helps streamline the process to avoid unnecessary delays.

9. What should I look for during a home tour?

Pay attention to the home's condition, layout, potential repairs, and resale value. Your realtor can spot red flags, advise on inspections, and help you determine if it’s a good investment.

10. How do I make a competitive offer on a home?

A strong offer includes a fair price based on market conditions, a solid pre-approval, and limited contingencies. A realtor uses market data to advise on the best offer strategy to help you win the home.

11. What happens after my offer is accepted?

You’ll enter the contract period, which includes home inspections, appraisals, loan approval, and title work. Your realtor will guide you through each step to ensure everything is on track for closing.

12. What inspections should I get before buying?

A general home inspection is a must! You may also need a foundation, termite, or roof inspection, depending on the home’s condition. A realtor helps coordinate these inspections and negotiate repairs if needed.

13. What if the home appraisal comes in lower than my offer?

If the appraisal is lower than the agreed price, your options include renegotiating, covering the difference, or walking away (if you have an appraisal contingency). A skilled realtor helps you navigate this situation to protect your investment.

14. How much will my monthly mortgage payment be?

Your monthly payment depends on the home price, loan type, interest rate, property taxes, and homeowners insurance. Your realtor can help you estimate your total costs and connect you with a lender for a personalized breakdown.

15. What should I do after closing on my home?

After closing, update your address, set up utilities, and review your home warranty. A great realtor stays in touch even after the sale, offering homeowner tips, market updates, and referrals for home maintenance services.

Your Home

Deserves The Best ...

Partner With

Professional Realtors

Who Are looking For Your Best Interest

Quick Links

Services

Main Contact Info

Professional real estate services in Houston, TX. Your trusted partner for buying, selling, and investing in real estate.

Home

About Us

Market Analysis

Main: (774) 252-7266

REALM Office:

24445 Tomball Parkway, Suite 100, Tomball, TX 77375

ALL Right Reserved. Copyright 2025